TeamHealth explores frequently asked questions about surprise medical billing and addresses the myths and facts about the debate.

1NDP Analytics, “An Assessment of the CBO Cost Estimate of S.1895: The Unintended Economic Consequences of the Proposed Healthcare Price Control System”, Nam D. Pham, Ph.D., Mary Donovan, September 2019

Go Deeper

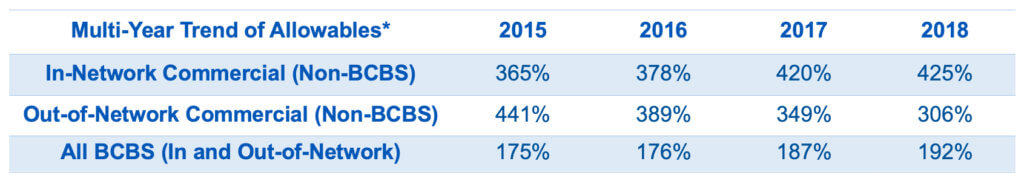

Go DeeperTeamHealth's Multi-Trend of Declining Out-of-Network Reimbursement

Studies recently published on the subject, and cited in media reports, including from USC-Brookings, generally state that emergency clinicians can remain out of network without losing volume because patients do not choose their emergency provider. This strong outside option maintains clinicians’ bargaining power with insurers. The studies in turn call for a median in-network rate, which in effect, resets the market.

The American College of Emergency Medicine (ACEP) has recently published a comprehensive discussion on the shortcomings of a separately released study appearing in the Journal of the American Medical Association (JAMA). Its authors state they are “especially concerned that research on surprise billing recently published … is fundamentally flawed.” ”

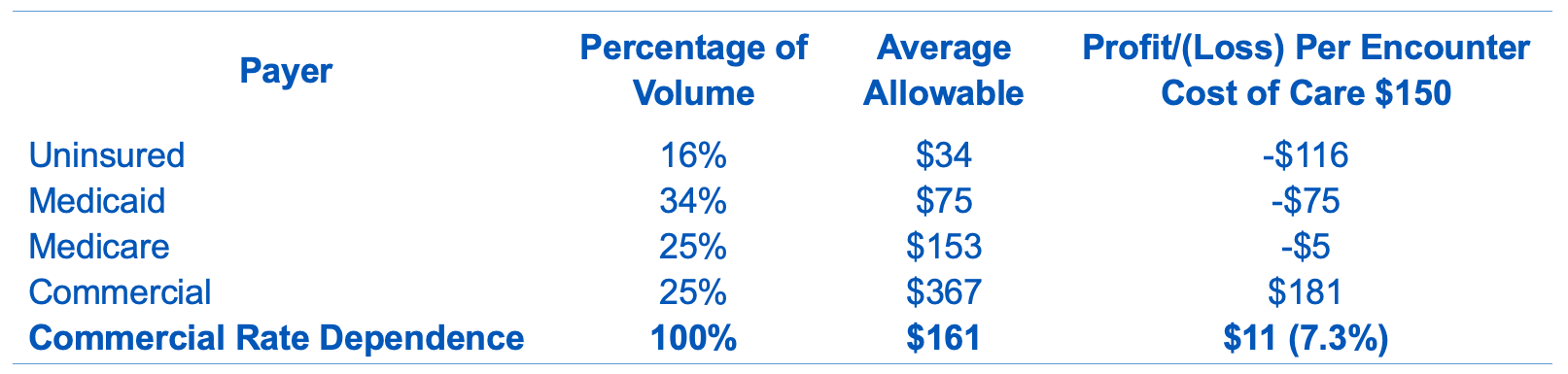

Absent this, government back-stop spending is required to off-set losses, which are most acutely felt in rural and indigent communities. This backstop would require further government spending, making optimal commercial reimbursement essential.

Go Deeper

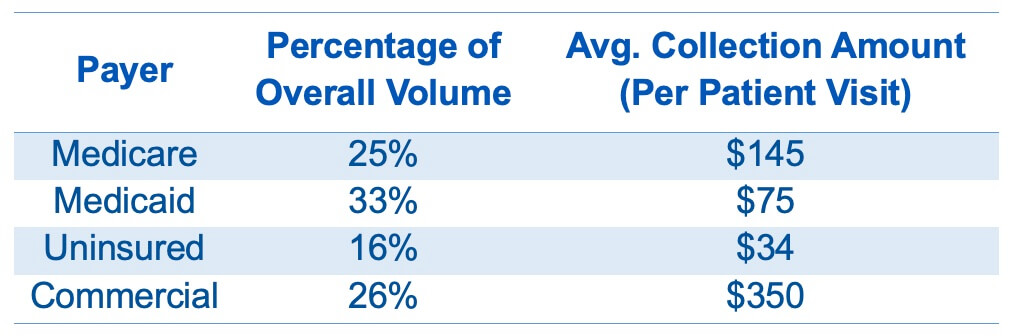

Go DeeperFor TeamHealth, a typical ED environment is reflected below:

Go Deeper

Go DeeperTeamHealth's uncollectible costs and component of bad debt:

Go Deeper

Go DeeperProfit/Loss Per Encounter Under Current Reimbursement Trends

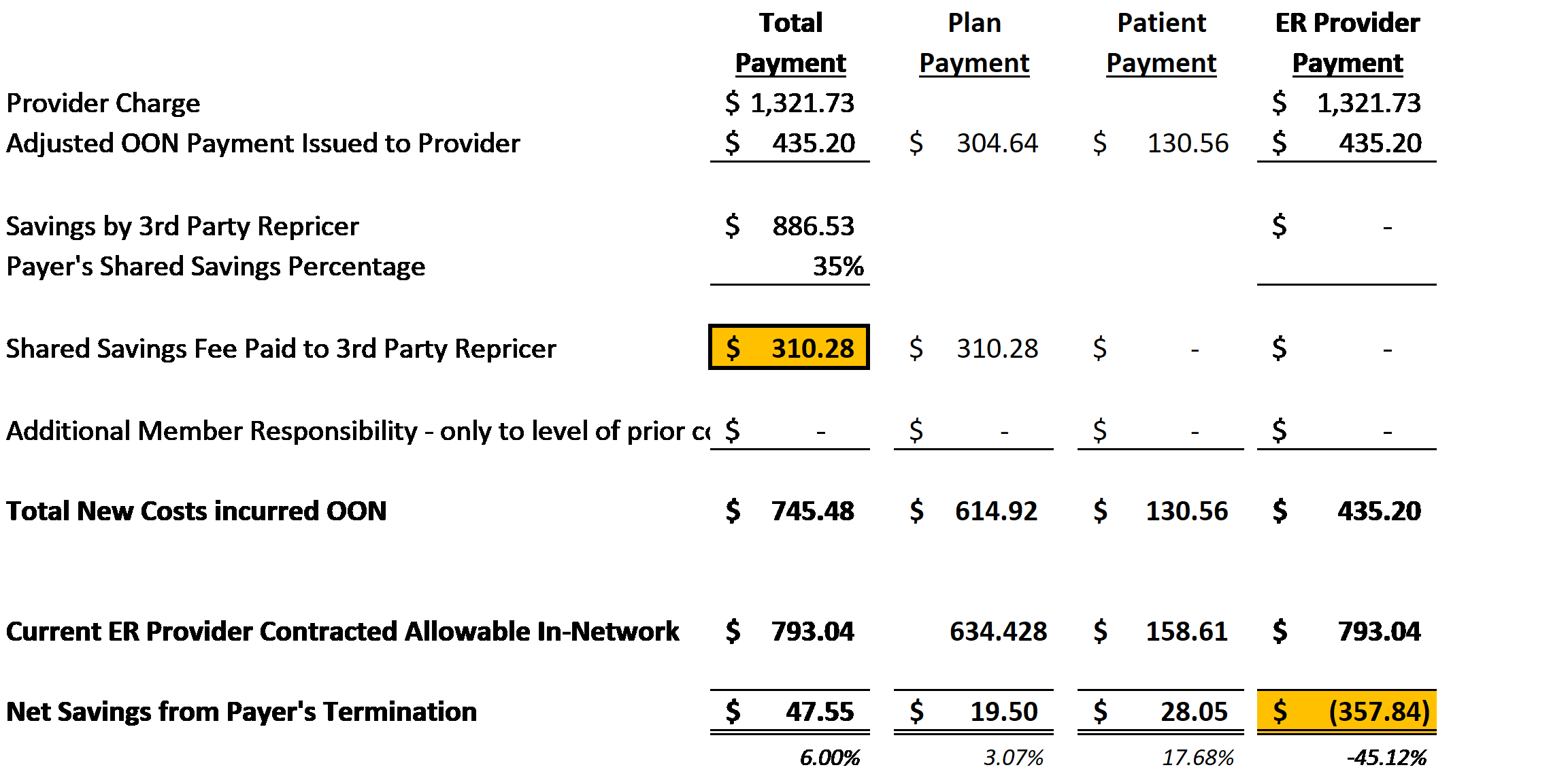

Out-of-Network Shared Savings Model between ASO and Third-Party Repricing Entity.

Illustration Purposes Only – Emergency Medicine High Acuity (E/M Code 99285)